The Ultimate Finance & Accounting Certification Bundle

277 Enrolled

8 Courses & 64 Hours

Deal Price$29.99

Suggested Price

$160.00

You save 81%

What's Included

$20.00 Value

Personal Finance #1 Goals, Planning & Time Value of Money

Robert Steele

89 Lessons (22h)

Lifetime

$20.00 Value

Personal Finance #2- Financial Statements & Budgeting

Robert Steele

33 Lessons (10h)

Lifetime

$20.00 Value

Personal Finance #3-Financial Services & Bank Reconciliation

Robert Steele

40 Lessons (8h)

Lifetime

$20.00 Value

Basics of Accounting

eduOlc

40 Lessons (5h)

Lifetime

$20.00 Value

Cost Management

eduOlc

45 Lessons (4h)

Lifetime

$20.00 Value

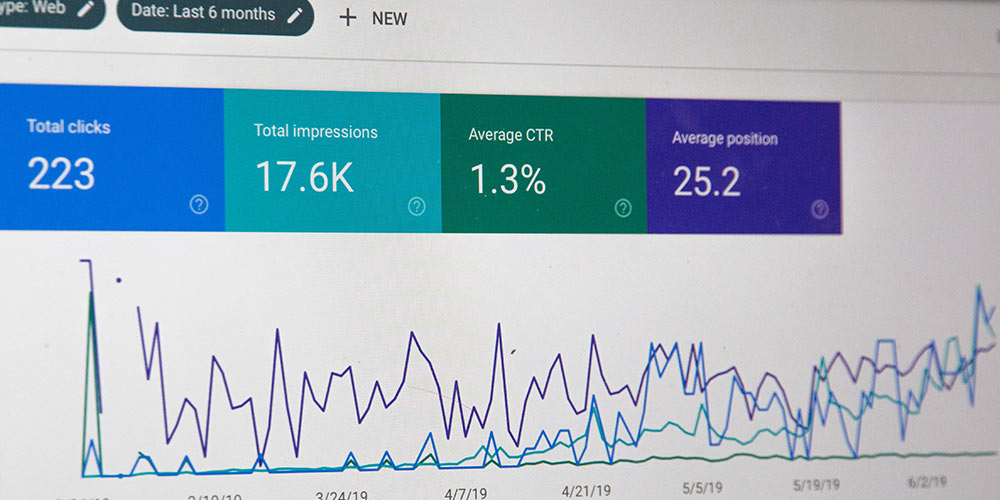

Corporate Finance & Investment Decisions

eduOlc

27 Lessons (3h)

Lifetime

$20.00 Value

Financial Statement & Decision Analysis

eduOlc

57 Lessons (7h)

Lifetime

$20.00 Value

Financial Budgeting & Forecasting for Business

eduOlc

58 Lessons (5h)

Lifetime

Terms

- Unredeemed licenses can be returned for store credit within 30 days of purchase. Once your license is redeemed, all sales are final.

1 Review

3/ 5

All reviews are from verified purchasers collected after purchase.

PS

Peter Schogel

Verified Buyer

Concepts are good. The training is very, very elementary. Glad I was able to speed up the pace. Consistent examples also help with the understanding of what is being taught. I would say this is being tought at a tenth grade level.

Feb 7, 2022

Your Cart

Your cart is empty. Continue Shopping!

Processing order...